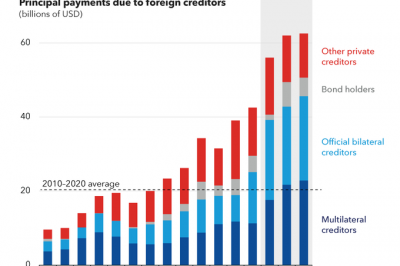

Washington, D.C., April 8, 2024(WAI): The IMF has sounded the alarm on low-income countries’ mounting debt challenges. As these nations grapple with the economic fallout from the pandemic and other external shocks, debt servicing costs are spiraling upward. Annual refinancing needs have surged to approximately $60 billion, a staggering threefold increase compared to the average in the decade leading up to 2020.

The Debt Burden: A Growing Challenge

Low-income countries find themselves caught in a precarious situation. High-interest payments and the relentless pace of debt repayment are straining national budgets. These financial constraints hinder critical investments in essential services, job creation, prosperity, and climate resilience. One telling metric is the share of government revenues allocated to servicing foreign creditors. Over the past decade, this burden has ballooned—now standing at around 14 percent for a typical low-income borrower, up from approximately 6 percent. In some economies, it reaches as high as 25 percent.

Also Read: Pakistan’s Vulnerability to Climate Change Crisis

The Refinancing Tightrope

Adding to the complexity, low-income countries face significant debt repayments due within the next two years. They must refinance approximately $60 billion of external debt annually, a daunting task that exceeds the historical average. However, competing demands for financing—both from advanced and emerging market economies and the urgent need to adapt to climate change—pose a substantial risk of a liquidity crunch. Failure to secure sufficient affordable financing could trigger a destabilizing debt crisis.

Understanding the Factors

Several factors contribute to the liquidity squeeze:

Pandemic-Driven Borrowing: Governments ramped up borrowing during the pandemic to mitigate its impact. While this trend reverses, the elevated debt levels persist, driving up servicing costs.

Central Bank Policies: Central banks have raised borrowing costs to combat inflation. This makes it more expensive for governments to issue new debt or refinance existing obligations. The uncertainty surrounding future rate cuts further exacerbates the situation.

A Call to Action

Concerted efforts are needed to address this financing challenge. Low-income countries, along with the broader international community, must collaborate to:

Enhance Debt Sustainability: Implement prudent fiscal policies, strengthen debt management frameworks, and explore innovative financing mechanisms.

Promote Transparency: Transparent communication about debt levels, terms, and repayment schedules is crucial.

Supportive International Environment: Advanced economies and international financial institutions should provide timely and targeted assistance to prevent liquidity crises.

The IMF remains committed to assisting low-income countries in navigating these treacherous waters. By working together, we can ensure a sustainable and resilient path forward.

I am Bushra Tahir. Doing BS in International Relations from National University Of Modern Languages ( NUML).