In the contemporary globalized world, banks play a crucial role in facilitating economic growth, promoting international trade, and providing financial services to individuals and businesses worldwide. The 4th of December marks the International Day of Banks every year. As we acknowledge this day, it is crucial to recognize these institutions’ profound impact in shaping the global economy and promoting financial stability.

Historically, banks and banking have been pivotal in shaping economies and societies. From ancient civilizations utilizing rudimentary banking systems to the modern global financial institutions we see today, the history of banks is a fascinating journey of innovation power.

As the go-between for savers and borrowers and the global financial system’s backbone, banks ensure the financial markets run smoothly.

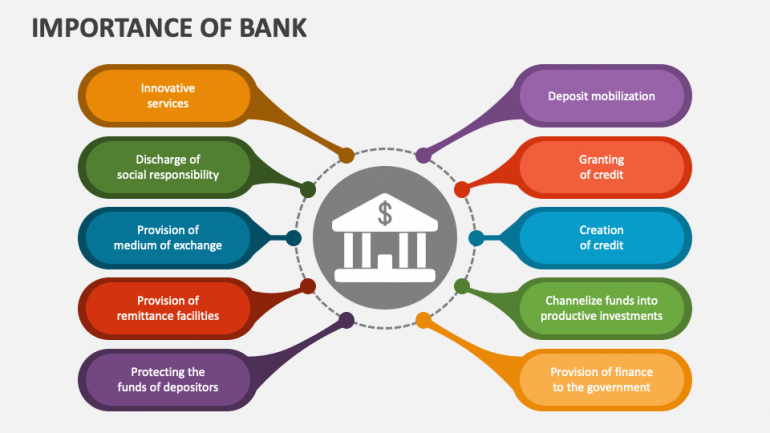

They provide a wide range of services, including savings and checking accounts, loans, credit cards, and investment opportunities, essential for individuals and businesses to manage their finances effectively. Moreover, banks also play a crucial role in promoting economic development by channeling funds into productive investments, supporting entrepreneurship, and creating employment opportunities.

In addition to their role in the global financial system, banks serve as a critical source of stability and security for individuals and businesses. By offering deposit insurance and implementing stringent risk management practices, banks reassure savers that their funds are safe and can be accessed when needed.

This encourages individuals to save and invest and enables businesses to confidently engage in economic activities, knowing that they can rely on banks for liquidity and financial support. Furthermore, banks play a vital role in facilitating international trade and commerce by providing services such as trade finance, foreign exchange transactions, and letters of credit.

Also Read: UN Secretary-General invokes Article 99, calls for Gaza ceasefire

Services like these help businesses navigate the complexities of global markets, reduce transaction costs, and mitigate risks associated with international trade. Furthermore, banks act as intermediaries between buyers and sellers in cross-border transactions, ensuring smooth and efficient settlement of payments. This encourages economic growth by promoting trade relationships between countries and facilitating the flow of goods and services across borders.

Banks also play a crucial role in facilitating international investment and capital flows. They provide financing options for businesses expanding overseas operations or investing in foreign markets. Through their extensive networks and expertise, banks connect investors with opportunities and help allocate capital to its most productive uses globally.

Not only economic growth but banks also encourage innovation and foster competition on a global scale. Also, banks act as custodians of assets, providing secure storage and management of valuable resources for individuals, businesses, and governments.

Where the movement of physical goods and money across borders requires a trusted intermediary, this function is essential in the context of international trade. Banks facilitate this process by offering various financial services such as trade finance, foreign exchange, and global payment systems.

Briefly, banks are like the conductors in the symphony of globalization. They harmonize money flow, connect nations, and empower businesses and individuals to dream big globally.

An International Relations graduate, with a keen interest in diverse areas of IR; diplomacy, global politics & human rights.